FINTECH SUMMIT UAE 2018

POST EVENT REPORT

FINTECH SUMMIT

On October 30, 2018, the Enterprise Fintech Summit was hosted by Naseba under the theme “Enterprise Grade, Real World, Now”, the summit promoted the most upcoming technologies in BFSI, fostered fintech collaboration and facilitated the procurement of financial technology solutions in the MENA region.

With 400+ attendees, representing 30+ countries, the summit is one of the best enterprises focused fintech gatherings in the MENA region. The #FINTECHDXB team would like to thank all attendees, speakers, sponsors, partners, and other summit stakeholders for contributing to the success of the show.

#FINTECHDXB 2018 in numbers

BFSI decision makers

Countries represented

Pre-scheduled meetings

Actual business meetings

Average Procurement time-frame (months)

SUMMIT FORMAT

RESEARCH AND PRE-QUALIFICATION

RESEARCH AND PRE-QUALIFICATION

All potential buyers are extensively researched and pre-qualified to ensure they have:

a. Decision-making authority

b. Minimum allocated budget

c. Clear buying strategy

ADVANCE NOTICE OF BUYERS

ADVANCE NOTICE OF BUYERS

One week prior to the summit you are sent a complete list of buyers’ project data; including their company name, products and services of interest and the budget allocated.

ONE-TO-ONE CONSULTATIONS

ONE-TO-ONE CONSULTATIONS

Meet buyers who have already expressed an interest in your type of products and services. These private sessions are designed to create deal-flow opportunities and new business relationships

KEYNOTE PRESENTATIONS

KEYNOTE PRESENTATIONS

Deliver a tailor-made presentation addressing the entire audience. You can either present a 15-minute keynote or a 5-minute elevator pitch..

PRODUCT SHOWCASING

PRODUCT SHOWCASING

The summit’s exhibition gives you the opportunity to showcase your range of products and services to all attending pre-qualified decision makers.

NETWORKING LUNCH

NETWORKING LUNCH

The networking lunch provides a perfect setting for meeting and networking with the who’s who of the UAE’s BFSI.

WHO ATTENDED

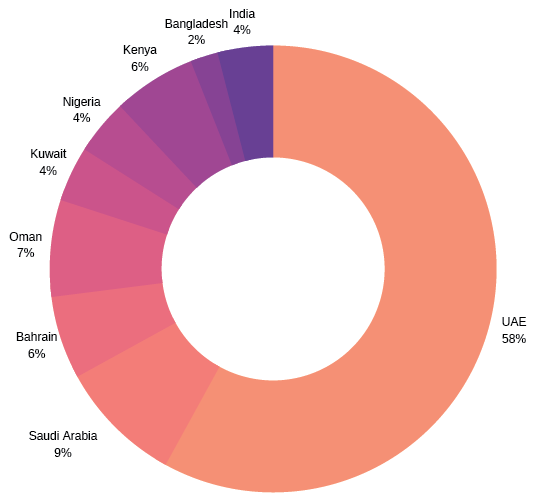

REGIONAL BREAKDOWN

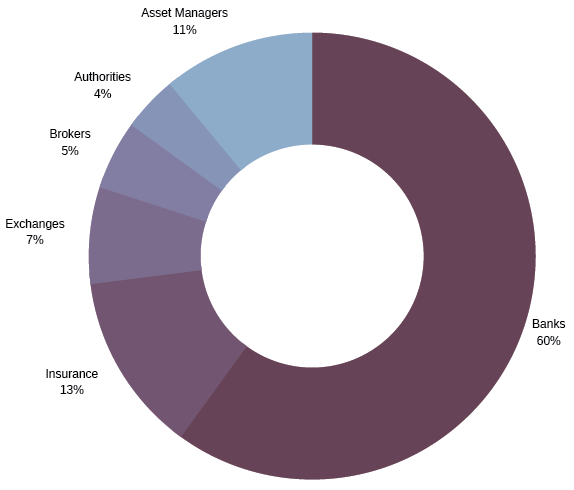

INDUSTRY BREAKDOWN

TOP COUNTRIES REPRESENTED

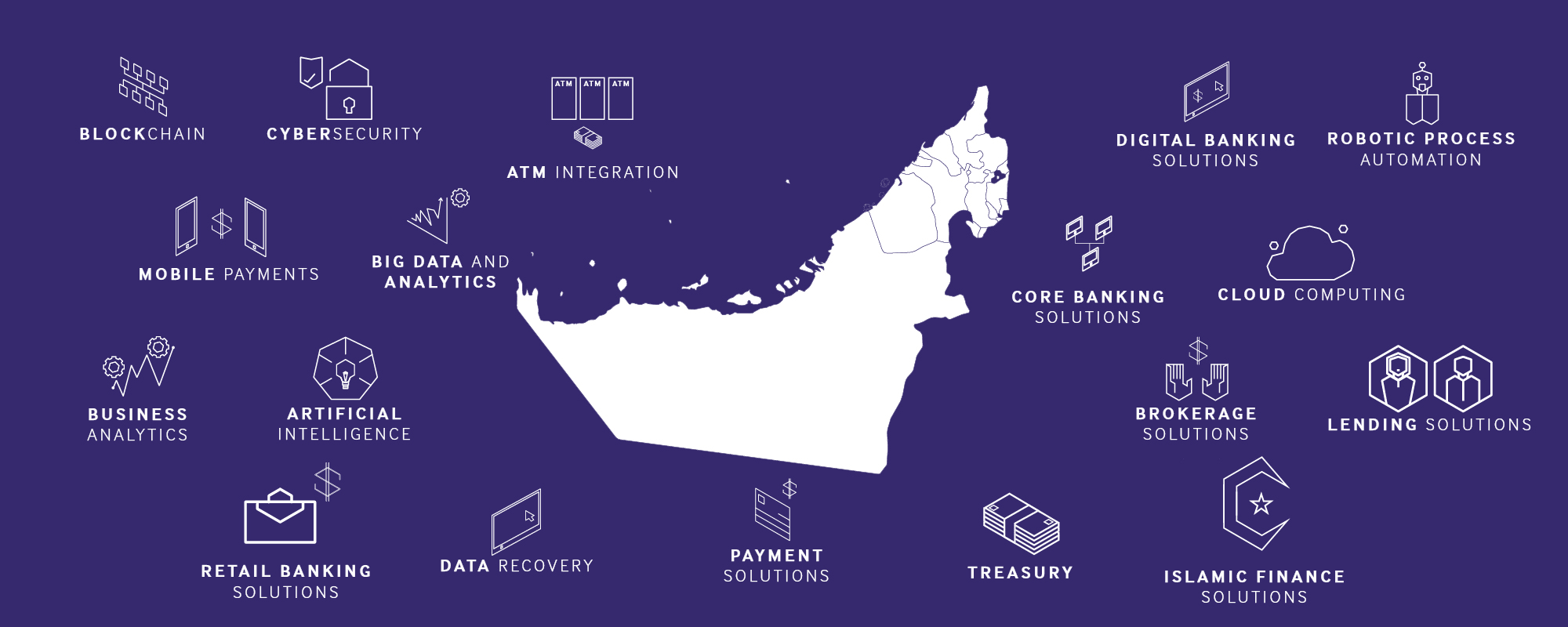

TOP SOLUTIONS SOURCED